With the Reserve Bank imposing on all banks to adhere to Loan to Value Ratio’s of a 40% deposit for investment properties, it’s unlikely that most people will ever get to expand their assets by saving for another deposit. If you have a home and a mortgage and would like to buy an investment property, we can offer you personalized and realistic advice to help you borrow funds for the deposit, and for the purchase of said investment property.

There is always a risk involved with borrowing, leveraging and purchasing investment properties, but with the right advice, we can show you how to responsibly leverage from the equity from within your home, to enable you to make your Investment purchase.

The Auckland market is rife with housing demand, so renting a property should bring you a steady income.

To be fair, a lot of out of Auckland cities and towns are also suffering a rental shortage which makes your options for picking up a suitable property (or properties) much more readily available.

Do you know how you can use your current home to get a mortgage on a new purchase?

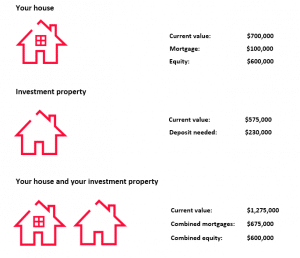

The equity in a house is its current value, minus the amount still owed. The more you pay off, and as your property increases in value, your equity likewise will grow.

You can work out how much equity you have in your house from these simple calculations:

If you would like to purchase an investment opportunity with a 40% deposit, you can borrow it from the equity in your existing home.

*This is based on a 40% deposit requirement for an investment property. Individual cases will be different.

** you are also required to retain 20% of unused equity within your home, and again, individual cases will be different

How much you can borrow depends on a lot of criteria… but your current deposit, the equity you have built up in other properties and your current mortgage repayments along with your ability to service your current financial situation are the main things that lenders will look at. Lenders will also consider the potential rental income on the new rental property.

Right now, borrowing costs are still considered low, but you still need to be smart when it comes to investment properties. The lower amount of cash invested, the higher your return. Your mortgage adviser will not only be able to suggest the best ways for you to afford a rental property, but will understand what make a good investment property and when is a good time to act.

Your advisor will also be able to recommend other professional contacts to help make the purchase of your new rental as stress free as possible. These contacts should also help to enhance the performance and maintenance of your new purchase. These contacts could look like Solicitors, Accountants, Insurance Advisors and Property Managers.

Don’t know where to start? Start with us… contact us today.